Effective in 2022, the No Surprises Act protects people covered under group and individual health plans from receiving surprise medical bills when they receive most emergency services, non-emergency services from out-of-network providers at in-network facilities, and services from out-of-network air ambulance service providers. It also establishes an independent dispute resolution process for payment disputes between plans and providers and provides new dispute resolution opportunities for uninsured and self-pay individuals when they receive a medical bill that is substantially greater than the good faith estimate they get from the provider. Based on CMS guidelines, the Act is better understood by breaking it down into two parts.

- Part one is intended for emergency care, in-patient and facility providers (e.g. hospitals, facilities, etc).

- If a patient has health coverage and receives emergency care; the act bans most common types of surprise bills.

- If a patient has health coverage and receives emergency care; the act bans most common types of surprise bills.

- Part two is transparency of medical services and costs being provided.

- If a patient is self-pay, uninsured or plans not to use their health coverage; the act states a Good Faith Estimate (GFE) of the cost of care is to be provided before visit.

- If a patient is self-pay, uninsured or plans not to use their health coverage; the act states a Good Faith Estimate (GFE) of the cost of care is to be provided before visit.

- If a patient has health coverage and receives emergency care; the act bans most common types of surprise bills.

- If a patient is self-pay, uninsured or plans not to use their health coverage; the act states a Good Faith Estimate (GFE) of the cost of care is to be provided before visit.

It is good to note that this act does not change the cost of service and is meant to protect individuals from large patient responsibilities they did not agree to, as well as transparency in medical service costs.

Part 1: No Surprise and Balance Billing

The No Surprises Act requires health plans and issuers to apply in-network cost-sharing terms and prohibits out-of-network providers, facilities, or providers of air ambulance services from billing individuals more than these in-network cost-sharing limits in 3 main scenarios:

- A person gets covered emergency services from an out-of-network provider or out-of network emergency facility

- A person gets covered non-emergency services from an out-of-network provider delivered as part of a visit to an in-network health care facility

- A person gets covered air ambulance services provided by an out-of-network provider of air ambulance services.

The processes for determining the patient’s cost sharing and the amount the plan must pay the OON facility or other OON provider are similar, with one significant difference.

First, if the care is provided in a state that participates in an All-Payer Model Agreement with the Centers for Medicare and Medicaid Services (CMS), then the amount the state approved under that Agreement as adequate payment for a given service is the amount the health plan must pay, and also serves as the basis for determining the patient’s cost sharing.

Second, many states have protections against balance billing, rules that establish procedures for calculating provider reimbursements. The new federal law keeps intact these state-specific rules.

Finally, the law establishes a general rule that the patient’s cost-sharing amount is based on the median in-network rate paid by all plans of the plan sponsor for similar items or services provided in the prior year, plus a cost -of living adjustment.

Example: Jerry participates in a self-insured health plan that requires 10% coinsurance for in-network emergency care and applies no deductible. Jerry receives emergency care from an OON physician in a state without an All-Payer Model Agreement. The physician typically charges $5,000 for services rendered, but the plan determines a typical allowable charge for such services from an in-network physician would be $2,500. Accordingly, the plan determines that Jerry’s co-insurance amount is $250.

As of 1/2022 states with laws already in place:

Emergency and Non-emergency laws by states:

| Emergency & Non-emergency laws | Emergency situation laws only | Air Ambulance laws | No related laws |

| Arizona | Indiana | Montana | Alabama |

| California | Iowa | North Dakota | Alaska |

| Colorado | Missouri | Arkansas | |

| Connecticut | Nevada | Hawaii | |

| Florida | North Carolina | Idaho | |

| Georgia | Pennsylvania | Kansas | |

| Illinois | Vermont | Kentucky | |

| Louisiana | Wisconsin | Nebraska | |

| Maine | Ohio | ||

| Maryland | Oklahoma | ||

| Massachusetts | South Carolina | ||

| Michigan | South Dakota | ||

| Minnesota | Utah | ||

| Mississippi | Wyoming | ||

| New Hampshire | |||

| New Jersey | |||

| New Mexico | |||

| New York | |||

| Oregon | |||

| Rhode Island | |||

| Tennessee | |||

| Texas | |||

| Virginia | |||

| Washington | |||

| West Virginia |

Patients that you are providing care for do have the option to continue seeing an OON provider, however a waiver must be provided and signed by the patient prior to balance billing. CMS-consent form

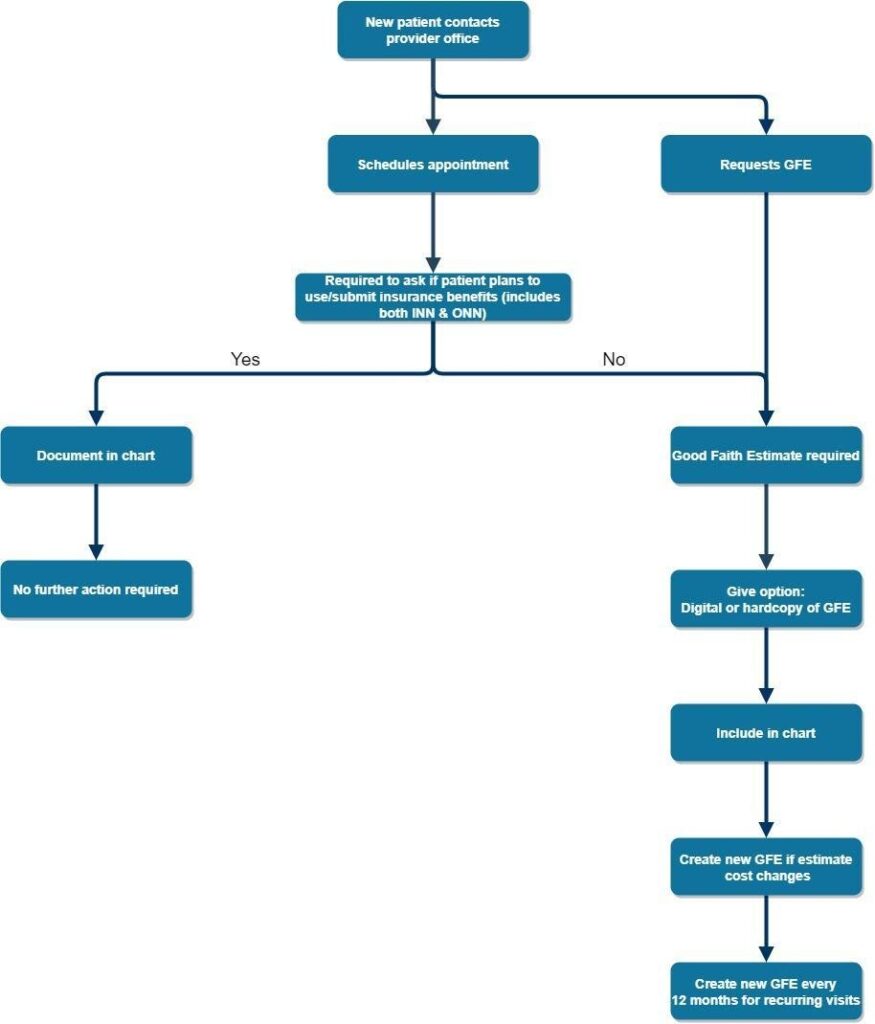

Part 2: Good Faith Estimate (GFE)

A GFE is simply an anticipated cost of care and services. When scheduling a patient the individual fielding the call must ask if the patient intends to apply insurance benefits. A GFE must include:

- Patient name, date of birth and diagnosis

- Provider name, NPI, TIN and location of services

- Billing codes for each service

- Cover date of service or dos range if recurring services are to be rendered

A practice can create their own GFE template including the required information. Here is an example of a GFE from cms.gov: https://www.cms.gov/files/document/good-faith-estimate-example.pdf

The act further states that the patient gets to determine how they receive the GFE. Some forms of delivery:

- Paper

- Electronically (secure)

- Verbal (follow up must be done in writing)

With the GFE comes other guidelines that are required.

- The convening provider (scheduling provider) is responsible for providing a full GFE by gathering estimates from all other providers or co-providers pertaining to the treatment of care

- Estimates of co-provider must be provided within 1 business day of GFE request from scheduling provider

- Estimates of co-provider must be provided within 1 business day of GFE request from scheduling provider

- Disclaimer on each GFE stating

- Only an estimate and costs can change

- Other services might be needed

- Patient has the right to initiate dispute

- GFE is not a contract and does not require patient accept services from provider

- Only an estimate and costs can change

- Other services might be needed

- Patient has the right to initiate dispute

- GFE is not a contract and does not require patient accept services from provider

- Estimates of co-provider must be provided within 1 business day of GFE request from scheduling provider

- Only an estimate and costs can change

- Other services might be needed

- Patient has the right to initiate dispute

- GFE is not a contract and does not require patient accept services from provider

Deadlines and Timelines:

The 10-3; 9-1 method is so far the most simplistic way to approach GFE timelines.

- 10-3 → if a scheduling call is 10 or more business days in advance; must provide GFE within 3 business days

- 9-1 → if a scheduling call is 3-9 business days in advance; must provide GFE within 1 business day

- If a scheduling call is less than 3 business days in advance; a GFE does not need to be provided, however best practice is still to provide a patient with a GFE in 1 business day

- If no appointment is scheduled and an individual requests a GFE; must provide GFE within 3 business days

Patient disputes and when to issue a new GFE

If what is billed to the patient is more than $400 above the GFE the patient has the right to file a dispute ($25 administrative fee) with the Department of Health and Human Services. The provider does have the ability to negotiate with the patient prior to come to a resolution. If this is not done and the patient wins there could be additional fines and penalties given, the patient gets billed what was stated on the GFE and the provider will need to pay the $25 administrative fee the disputer was required to pay to initiate the dispute. With this all being said, when is a good time to update or provide a new GFE?

- Change in course of treatment

- Change in treatment costs

- Realization cost of services will exceed current GFE

- Change of diagnosis

- Due to having to issue a tentative diagnosis on initial GFE. If the diagnosis changes after care a new GFE should be provided

- During the course of treatment if a diagnosis changes but the diagnosis does not change the treatment or cost; a second GFE is not required

- Due to having to issue a tentative diagnosis on initial GFE. If the diagnosis changes after care a new GFE should be provided

- During the course of treatment if a diagnosis changes but the diagnosis does not change the treatment or cost; a second GFE is not required

- Due to having to issue a tentative diagnosis on initial GFE. If the diagnosis changes after care a new GFE should be provided

- During the course of treatment if a diagnosis changes but the diagnosis does not change the treatment or cost; a second GFE is not required

What if my state has a surprise billing law?

The No Surprises Act supplements state surprise billing laws; it does not supplant them. The No Surprises Act instead creates a “floor” for consumer protections against surprise bills from out-of-network providers and related higher cost-sharing responsibility for patients. So as a general matter, as long as a state’s surprise billing law provides at least the same level of consumer protections against surprise bills and higher cost-sharing as does the No Surprises Act and its implementing regulations, the state law generally will apply.

Are you ready to find out how Coronis Health can maximize your revenue? Schedule a free financial health audit today.