For anesthesia groups wishing to remain independent, strategic planning is a must. As part of these planning sessions, practices must take into account the impact of an increasingly depressed Medicare reimbursement landscape. Today’s article looks at the relevant trends and strategies groups will want to consider.

Declining Medicare payment rates for anesthesia are probably more significant than most anesthesia providers realize. Most providers understand that these governmental rates are significantly discounted and that the percentage of Medicare cases greatly impacts the potential overall yield per billed unit. What most do not stop to think about is the strategic impact of American demographic trends and that the migration of cases from traditional inpatient venues to outpatient facilities has dramatically changed the economics of call coverage. The dramatic increase in endoscopic anesthesia cases has created a whole new set of challenges and opportunities. As Medicare coverage options evolve, it becomes increasingly difficult to optimize practice revenue potential.

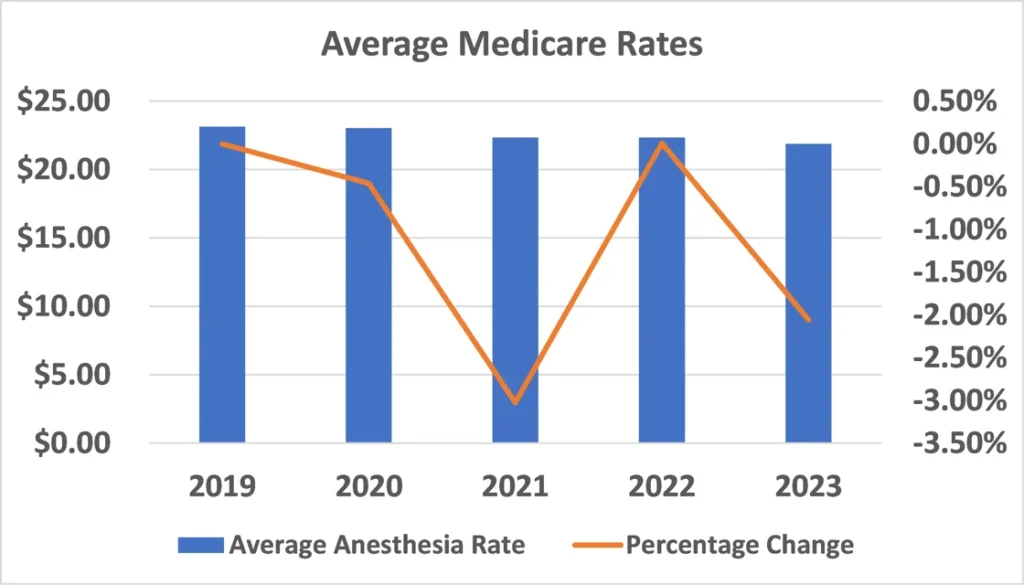

Medicare Rates Continue to Erode

The sad but unfortunate reality is that current Medicare payment rates for anesthesia do not begin to cover the cost of providing the care. A review of data for six Coronis clients (two from the East, two from the Midwest and two from the west) reveals an average anesthesia rate for 2023 of $21.88, and the projection is for this rate to drop further in 2024. This represents a decrease of 5.5 percent from the 2019 rate of $23.14. As a point of reference, if an anesthesia provider generates 10.000 billable units per year and the only source of payment is Medicare, this would only yield total revenue potential of $218,800, and this assumes that all potential revenue could be collected. The reality is that Medicare intermediaries only pay 80 percent of the allowable, leaving a remaining 20 percent to be collected from secondary coverage or the patient. If the patient is covered by Medicare and MediCal, and lives in California, there is no additional 20 percent payment.

If one wanted to benchmark these rates against the Consumer Price Index for Medical services, which has been tracking at about five percent per year, the problem is obvious. The deficit must be covered by payments from non-Medicare plans and hospital support. This is why the greatest challenge facing virtually every practice these days is to generate enough revenue to recruit and retain an appropriate number of qualified providers.

The Challenge is Compounded by the Size of the Medicare Population

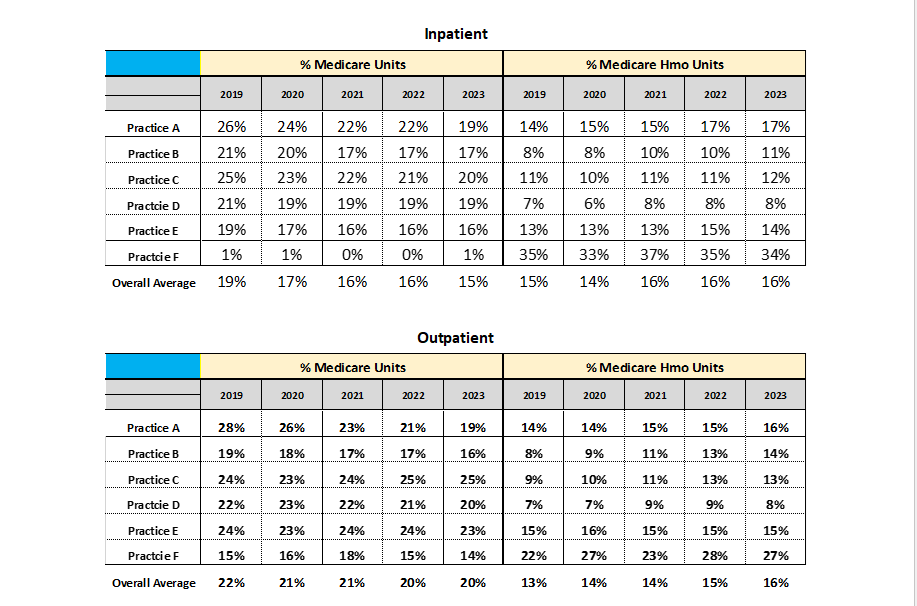

CMS data and projections indicate that currently about 18 percent of all Americans are covered by Medicare. Given an aging population, the projection is that the Medicare population will increase dramatically as baby boomers continue to age. The fastest growing segment of the American population is people over 80. The good news is that, as the tables below indicate, the Medicare surgical population has not increased over the past five years, although this may be partially explained by the impact of the pandemic in 2021 and 2022. The overall average Medicare percentage for the six practices stayed at about 35 percent, which is obviously not representative of all practices across the country. Not included in this percentage is the Medicaid population, which can be as much as an additional 10 percent of severely discounted units.

The data for the six practices indicates that the percentage of outpatient cases continues to increase. While about 52 percent of total billed units were generated in outpatient venues in 2019, the percentage has now increased to 60 percent.

The percentage of patients who have opted for HMO plans is significant. While many of these HMO plans minimize the patient’s responsibility, many also make it more difficult for anesthesia providers to get paid.

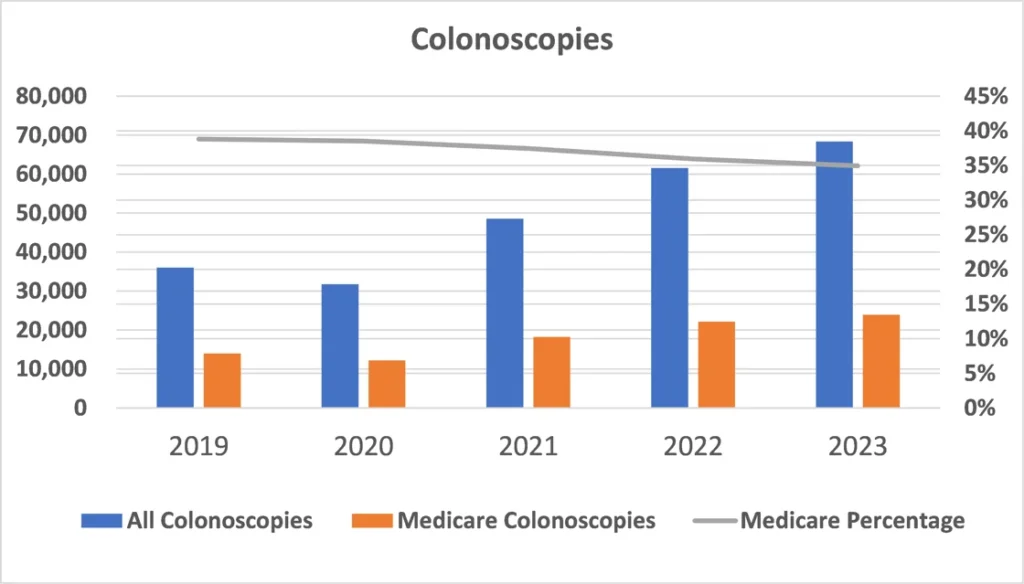

The Impact of Colonoscopy

The dramatic increase in anesthetics for endoscopy and especially colonoscopy has created an additional set of challenges. While these cases are typically short in duration, productivity is the key to profitability. Recent coding changes also had the effect of reducing the base value for most cases and thereby diminishing the revenue potential. At an average rate of $21.88, the typical Medicare colonoscopy only generates $131.28 when paid in full.

While it is true that, for many anesthesia practices, endoscopy has been the fastest growing and most profitable line of business, this trend may well have run its course.

Coverage Implications

As practices expand their scope to include a more diverse collection of venues, coverage requirements become more difficult to meet. Typically, for a large multi-site practice, 60 percent of all units are generated in outpatient venues. It used to be that only hospitals would provide financial support, but many practices are now having to request subsidies from outpatient facilities. This is simply a function of the fact that, as the number of anesthetizing locations increases, too often the utilization decreases.

Since 75 percent of the revenue generated per location is typically produced between 7 AM and 3 PM, this means that night coverage is usually a financial loss leader. There is a concept that has started to gain currency: the misery index. It reflects the percentage of cases that must be done after 5 PM and on the weekends.

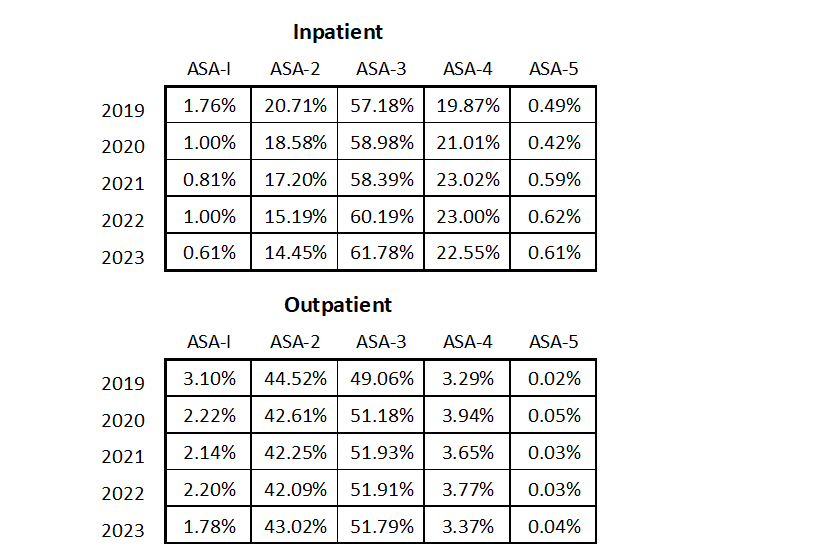

The tables below indicate changes in the acuity of Medicare patient care over the five-year period. Note that the acuity of inpatient care has increased, as compared to the acuity of outpatient care that has remained fairly constant. These percentages represent aggregated data for the six practices included here. In other words, traditional inpatient venues are covering increasingly older and sicker patients.

Managing the Medicare Challenge

An ongoing decline in Medicare rates is inevitable. This is just one of the many challenges with which today’s anesthesia practices must contend. As is so often the case in business, one practice’s challenge is another practice’s opportunity. Inevitably, this means thinking outside the box. Most practices have three options. This is where strategy is critical. They can (a) try to replace the falling Medicare revenue with other revenue, such as higher rates from commercial payers; (b) attempt to increase their subsidy from the facilities they serve, which seems to be the most common option most are exercising; or (c) explore ways to reduce the cost of anesthesia care through improved operating room efficiency and more creative scheduling. Status quo is never a viable option. If independent practice is the goal, then exploring strategic options is the only solution.

Should you have any questions, please reach out to your account executive.