On the plains of Salisbury, England lies a strange mystery. Since the 1970s, farmers and townsfolk have awakened to see massive geometric patterns formed within the otherwise bucolic fields of wheat, rye and barley. At first, they were simple circles that could be easily seen from the air; but, in the following years, the patterns became increasingly intricate and constituted in the minds of many actual works of art.

Patterns do shift over time—whether that involves those curious crop circles or the way in which medical providers submit their services for billing. When it comes to claim submissions, many chronic pain providers have no doubt wondered how their colleagues within the specialty are billing for new and established office/outpatient visits (CPT codes 99202-99205 and 99211-99215, respectively) since the somewhat recent change in how evaluation and management (E/M) code levels are determined. That is, to what extent, if any, has the typical pain practice changed its E/M billing pattern now that a visit level can be based on either time or medical decision-making (MDM)?

The Shape of Things to Come

We used to talk about the importance of understanding and remaining reasonably within the “bell curve” of E/M coding. Picture two bells connected to each other at their base—one on top and an inverted bell below. The mirrored bells narrow near the top and bottom but widen in the middle. Using this configuration as a billing model, you would expect the typical medical practice to bill out a higher percentage of mid-level services (wide in the middle) and a lower percentage of either low-level or high-level E/M codes (narrow at the top and bottom). What we historically cautioned against was the billing out of an inordinately high volume of level 4 and 5 visits as this could raise red flags with the payer and potentially trigger an audit. The reason? Such a pattern of claim submissions is outside the expected bell curve.

Of course, with a chronic pain practice, you’re going to have a higher percentage of patients with comorbidities that could add to the complexity of the MDM component; but, under the old coding regime, your visit level determination would be based on two other components, as well (namely, patient history and exam)—with the overall coding level being determined by the “weakest link,” i.e., the lowest level component. So, you would not expect nearly every patient to reach a level 4 or 5 service—even in this type of practice. Now, however, the bell curve may be shifting.

As you know, the Centers for Medicare and Medicaid Services (CMS) changed the determinants for arriving at an E/M code level back in 2021. Instead of having to consider three out of three components (history, exam and MDM) for new patients, or two out of three components for established patients (and making sure that you code to the lowest of those two or three components), now you can base the code level on only one component. To make things even easier, you have the option of choosing which component to use in this level determination: time or MDM. If the time you spent with the patient gets you a higher code level, you can use time as your basis for billing. Alternatively, if MDM allows for a higher level, you can choose that as your determinant for the visit.

So, the question is this: has there been a shift in the shape of the typical bell curve in chronic pain practices since the implementation of the new billing standard for E/M services?

The New Normal?

Recently, Medicare released data showing percentages for the submission of each E/M code level for the office or outpatient setting. Such data is typically provided on a two-year retrospective basis; thus, the results released at the end of 2023 reflect claims that were submitted back in 2021—which marks the first year for the shift in E/M code level calculation.

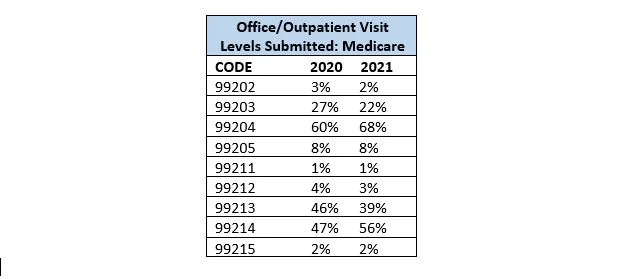

Medicare released its E/M breakdown according to medical specialty. Pain management visits were associated with the anesthesia specialty. With that in mind, the list below shows the submission percentages for “anesthesiology” relative to E/M office/outpatient codes for 2020 (the year before the change in code level determination) and 2021 (the year after the change).

Based on the above Medicare numbers, there was a material shift in the shape of the bell curve of E/M coding from 2020 to 2021. Specifically, the percentage of level 4 E/M visits (99204 and 99214) increased noticeably in the first year of the new coding regime. This indicates that pain providers, as a whole, found it easier to reach a level 4 visit when they didn’t have to code to the lowest component (history, exam, MDM) based on the pre-2021 methodology but rather bill based on the most advantageous of two components: time or MDM.

So, the bell curve has morphed into a rather odd-looking instrument, ringing out a signal that Medicare has surely heard. These are, after all, the payer’s own numbers based on its own review of claims submission data. For the time being, Medicare will have to accept this shift in higher level 4 coding since pain providers are playing by the new rules that the government itself approved.

One other note should be mentioned here. If the 2021 percentages—the latest numbers we have—represent the new bell curve that is acknowledged and presumably accepted by Medicare for the specialty, then pain providers might want to avoid submitting large volumes of claims that are noticeably outside this curve. For example, you don’t want to significantly reduce your level 3 visit volume while simultaneously boosting your levels 4 and 5. If the 2021 data suggests that the average pain practice is submitting 39 percent of their established office visits with 99213, you don’t want to lower that to 15 percent in favor of even higher percentages for 99214 and 99215. That could send out an alarm to auditors who love to look for anomalies in coding patterns, i.e., providers who bill outside the norm.